8.4.1: Operational costs

- Page ID

- 78354

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)As pointed out above, it is under common agreement to establish a classification based in fixed costs (\(c_f\)) and variable costs (\(c_v\)):

\[c = c_f + c_v BT, \nonumber \]

where c are the operational costs, and \(BT\) refers to Block Time.16 The difference between \(BT\) and flight time is small in long flights, but it can be important in short flights. BT can be expressed as a function of the aircraft range, \(R\), as follows:

\[BT = A + B \cdot R + C \cdot \ln R. \nonumber \]

where \(A\), \(B\) and \(C\) are parameters set by the airline. A linear approximation is usually adopted:

\[BT = A + B \cdot R. \nonumber \]

Therefore the operation costs can be expressed either as a function of block time or range:

\[c = c_f + c_v BT = c_f + c_v (A + B \cdot R) = c_f' + c_v' \cdot R. \nonumber \]

Using these expressions one can generate the so called cost indicators: cost per unity of time, range, payload, or any other parameter to be taken into account at accounting level. Three of these cost indicators are:

The hourly costs:

\[\dfrac{c}{BT} = c_v + \dfrac{c_f}{A + B \cdot R}. \nonumber \]

The kilometric costs:

\[\dfrac{c}{R} = \dfrac{c_f'}{R} + c_v' = \dfrac{c_f'}{R} + Bc_v. \nonumber \]

The cost per offered ton and kilometer (\(OTK\)):

\[\dfrac{c}{(MPL) \cdot R} = \dfrac{c_f'}{(MPL) \cdot R} + \dfrac{c_v B}{MPL}, \nonumber \]

where \(MPL\) refers to maximum payload.

Besides this cost ratios, there are also some other ratios in which airlines generally measure their operations. These are Passenger Kilometer Carried (\(PKC\)), the passenger carried per kilometer flown; Seat Kilometer Offered (\(SKO\)), seats offered per kilometer flown; the Factor of Occupancy (\(FO=PKC/SKO\)):

\[PKC = OTK \cdot FO. \nonumber \]

These three ratios, together with the above described cost ratios represent the best metric to analyze the competitiveness of an airline.

Structure of the operational costs

We can identify four main groups:

- Labour;

- Fuel;

- Aircraft rentals and depreciation & amortization; and

- Others: Maintenance, landing and air navigation fees, handling, ticketing, etc.

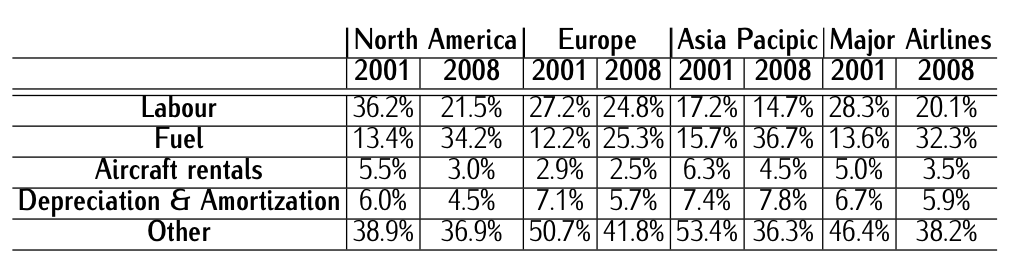

Table 8.11: Evolution of airlines’ operational costs 2001-2008. Source IATA.

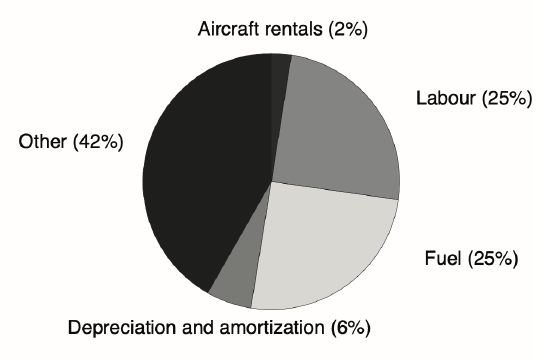

Figure 8.7: European % share of airline operational costs in 2008. Data retrieved from IATA.

Labour costs Labour has been traditionally the main budget item not only for airline companies, but also for any other company. However, the world has shifted to one more deregulated and globalized. This fact has lead to a less stable labour market, in which airlines companies are not a exception.

Therefore, meanwhile traditional flag companies had a very consolidated labour staff, the airline deregulation in the 70s brought the appearance of fierce competitors as the low cost companies were (and still are). In that sense all companies have been making big efforts in reducing their labour cost as we can see in Table 8.11 and Figure 8.7 and this tendency will continue growing.

Nowadays one can find staff with the same qualification and responsibilities in very different contractual conditions, or even people that works for free (as it is the case of many pilots pursuing the aircraft type habilitation).

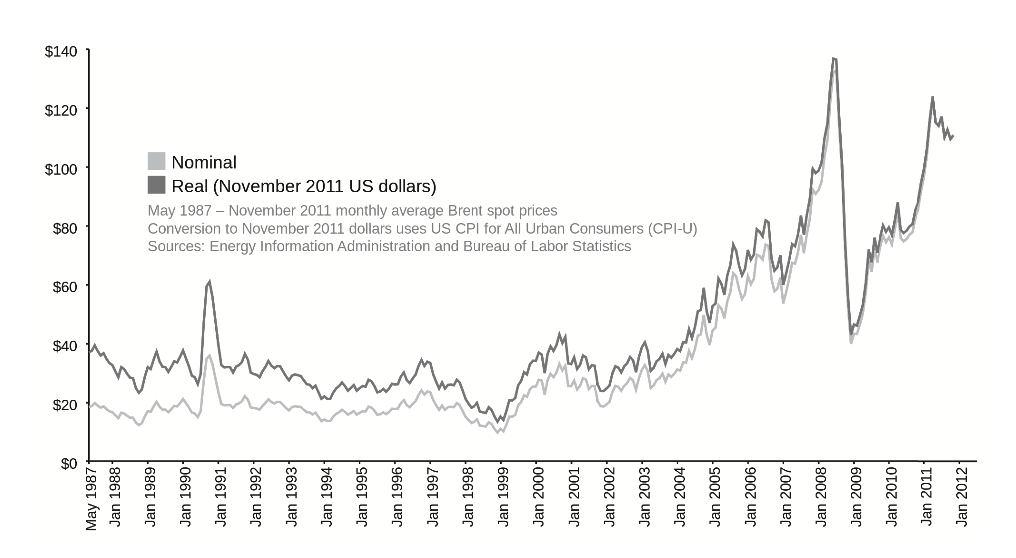

Figure 8.8: Evolution of the price of petroleum 1987-2012. © TomTheHand / Wikimedia Commons / CC-BY-SA-3.0.

Fuel costs: The propellant used in aviation are typically kerosenes, which it is produced derived from the crude oil (or petroleum). The crude oil is a natural, limited resource which is under high demand. It is also a focus for geo-politic conflicts. Therefore its price is highly volatile in the short term and this logically affects airline companies in their operating cost structures. However, as Figure 8.8 illustrates, the long-term evolution of petroleum price has shown since 2000 a clear increasing tendency in both real and nominal value. This increase in the price of fuel has modified substantially the operational cost structure of airline companies; in some cases fuel expenses represent 30-40% of the total operating costs. Notice that in Europe the impact was mitigated due to the strength of Euro with respect to the Dollar, but most likely today in European companies the weight of fuel costs is as well in the 30-40% of the total operating costs.

Since the crude oil is limited as a natural resource and day after day the extractions are more expensive, and since the demand is increasing due to the rapid evolution of countries such China, India, Brazil, etc., forecasts predict that this tendency or price increase will continue. Therefore, airlines will have to either increase tickets (as they have done); reduce other costs items; and encourage research on the direction of alternative fuels.

Maintenance: The maintenance costs depend on the maintenance program approved by the company, the complexity of the aircraft design (number of pieces), the reliability of the aircraft, and the price of the spare pieces. The maintenance is carried out at different levels after the dictation of an inspection:

- Routine check: At the gate after every single flight (before first flight or at each stop when in transit). It consists of visual inspection; fluid levels; tyres and brakes; and emergency equipment. The standard duration is around 45 to 1 hour, however the minimum required time to perform it is 20 minutes.

- Check A: At the gate every 500 flight hours. It consists of routine light maintenance and engine inspection. The standard duration is around 8-10 hours (a night).

- Check B: At the gate every 1500 flight hours. It is similar to A check but with different tasks and may occur between consecutive A checks. The duration is between 10 hours and 1 day.

- Check C: In the hangar every 15-18 moths on service. It consists of a structural inspection of airframe and opening access panels; routine and non routine maintenance; and run-in tests. The duration ranges between 3 days and 1 week.

- Check D: In the hangar after some years (around 8) of service. This last level requires a complete revision (overhaul). It consists of major structural inspection of airframe after paint removal; engines, landing gear, and flaps removed; instruments, electronic, and electrical equipment removed; interior fittings (seats and panels) removed; hydraulic and pneumatic components removed. The duration is around 1 month with the aircraft out of service.

The traditional companies used to have internal maintenance services, typically hosted in their hubs. However, this strategy is shifting due to different flight strategies (point to point) and also to take advantage of reduced cost in determined geographic zones. Therefore, nowadays many flight companies externalize these services. This is the last aspect in which the low cost strategies have modified the air transportation industry.

Regarding spare pieces, meanwhile in other industries do not exist a clear regulation in regard of spare pieces, the aeronautical industry and the american government have been pioneers regulating the market of spare pieces. Both original manufactures and spare companies can provide spare pieces. In order private companies to be allowed to commerce sparse pieces they need an habilitation named PMA (Parts Manufacturer Approval), while the original pieces referred to as OEMs (Original Equipment Manufactures).

Handling: The handling services consist of the assistance on the ground given to aircraft, passenger, and freight, so that a stopover in any airport is carried out properly. Handling include devices, vehicles, and services such fuel refilling, aircraft guidance, luggage management, or cabin cleaning.

The handling services can be grouped into:

- Aircraft handling.

- Operational handling.

- Payload handling.

Aircraft handling defines the servicing of an aircraft while it is on the ground, usually parked at a terminal gate of an airport. It includes:

- Operations: includes communications, download and load of cargo, passenger transportation, assistance for turn on, pushback, etc.;

- Cleaning: exterior cleaning, cabin clean up, restrooms, ice or snow, etc.; and

- Fill in and out: Fuel, oil, electricity, air conditioning, etc.;

Operational handling assits in:

- Administrative assistance.

- Flight operations: includes dispatch preparation and modifications on the flight plan;

- Line maintenance: includes the maintenance prior departure, spare services and reservation of parking lot or hangar;

- Catering: includes the unloading of unused food and drink from the aircraft, and the loading of fresh food and drink for passengers and crew. Airline meals are typically delivered in trolleys. Empty or trash-filled trolley from the previous flight are replaced with fresh ones. Meals are prepared mostly on the ground in order to minimize the amount of preparation (apart from chilling or reheating) required in the air.

Payload handling refers to:

- Passenger handling: includes assistance in departure, arrival and transit, tickets and passport control, check-in, and luggage transportation towards the classification area;

- Classification, load, and download of luggage;

- Freight and main services;

- Transportation of passengers, crew and payload between different airport terminals.

As in the case of maintenance, the handling services used to be handled by flag companies. However, this activity was liberalized (in Europe, in the 90s) and it is being increasingly outsourced. As a result, many independent company have arisen in past 10-15 years.

Landing and air navigation fees: According to \(IATA\), the landing fees and air navigation costs represent around 10% of the operating cost for airline companies. Each nation establishes navigation fees due to services provided when overflying an airspace region under its sovereignty. Moreover, each airport establishes landing fees for the services provided to the aircraft when approaching and landing. In Spain, \(AENA\) charges for approaching (notice that can be interpreted as a landing fee).

The landing fee is established taking into consideration the MTOW of the aircraft and the type of flight (Schengen, International, etc.). \(AENA\) gives therefore a unitary fee that must be multiplied by the aircraft \(MTOW\). The formula is as follows:

\[L_{fee} = u_l \cdot (\dfrac{MTOW}{50} )^{0.9}, \nonumber \]

where \(L_{fee}\) is the total landing fee, \(u_l\) is the unitary landing fee and \(MTOW\) is the maximum take off weight (in tons) of the aircraft. For instance, this unitary fee depends on the airport and ranges 12 to 17 €.

On the other hand, the air navigation fees in Europe are invoiced and charged by Eurocontrol by means of the following formula.

\[\text{Navigation fee} = \text{unit rate} \cdot \text{distance coef} \cdot \text{weight coef} \nonumber \]

where the unit rate is established in the different European \(FIR/UIR\)17. For instance, in Spain, the unit rates of \(FIR\) Madrid, \(FIR\) Barcelona and \(FIR\) Canarias, respectively, 71.84 €, 71.84 € and 58.52 €. The distance coefficient is the orthodromic distance (in nautical miles) over 100. The weight coefficient is \(\sqrt{MTOW/50}\). Therefore, the navigation fee results in:

\[\text{Navigation fee} = \text{unit rate} \cdot \dfrac{d}{100} \cdot \sqrt{\dfrac{MTOW}{50}}. \nonumber \]

Depreciation: The depreciation of an aircraft (the most important good airline companies have in their accounting) is typically imposed by the national (or international) accounting regulations, and it is typically associated to the following factors:

- Use.

- The course of time.

- Technological obsolescence.

The Use, corresponding to flight hour (also referred to as block hour), could be included somehow into the DOC. The depreciation due to the course of time is due to the loss of efficiency with respect to more modern aircraft. Last but not least, the incorporation by the competitors of a technological breakthrough (such, for instance, Airbus with the fly-by-wire) implies that the aircraft get depreciated immediately in the market.

The estimation of depreciation set the pace for fleet renovation, and it is obviously association to the utility life of the aircraft. A wide-body jet is typically depreciated to a residual value of (0-10%) in 14-20 years. The utility life of an aircraft is set to 30 years.

Aircraft acquisition: The acquisition of an aircraft is a costly financial operation, indeed the companies typically acquire several aircraft at the same time, not only one. These investments must financed by means of bank loans (also by increases of capital, emissions of bonds and obligations, etc.), which imply interests.

Other forms of aircraft disposition are the operational leasing (a simply renting) and the financial leasing (renting with the right of formal acquisition). Among the operational leasing there exist different types:

- Dry leasing: the aircraft is all set to be operated, but it does not include crew, maintenance, nor fuel. Sometimes the insurance is neither included.

- Wet leasing: like dry leasing but including crew.

- \(ACMI\) leasing: includes Aircraft, Crew, Maintenance and Insurance.

- Charter leasing: Includes everything, even airport and air navigation fees.

There exist important leasing companies, such \(GECAS\), \(ILFC\), Boeing Capital Corp or \(CIT\) group. Notice that approximately half of the total orders made to the manufactures correspond to leasing companies. The financial leasing is also very extended. The only difference with operational leasing is that they include a policy with the operator’s right to acquire the aircraft at a preset date and price.

Insurances: An insurance is a practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium. The characteristic of an insurance contract is the displacement of a risk by means of paying a price.

The aeronautical insurance, when compared to maritime or terrestrial, have some peculiarities: The reality of air traffic proofs that air accidents occur with rather low regularity, which makes difficult to apply the rules of big numbers. Moreover, exceptionally an accident produces partial damage, but, on the other hand, catastrophic damages including death of crew and passengers, resulting in high compensatory payments. In these circumstances, the insurance companies have agreed to subscribe common insurances so that the risk is hold by a pool of insurance companies.

16. The time in block hours is the time between the instant in which the aircraft is pulled out in the platform and the instant in which the aircraft parks at the destination airport. It includes, therefore, taxi out and taxi in.

17. Flying Information Region and Upper Information Region. The meanings of these regions will be studied in Chapter 10.