7.3: Variable Energy Resources and Three Economic Challenges

- Page ID

- 47796

Variable Energy Resources and Three Economic Challenges

Please read the “Overview” section (through page 14) from "Managing Variable Energy Resources to Increase Renewable Electricity's Contribution to the Grid."

The terms “renewable energy resources” and “variable energy resources” are often used interchangeably when applied to electric power generation. The two are, in fact, not the same, although there is some overlap. The term “Variable Energy Resource” (VER) refers to any generation resource whose output is not perfectly controllable by a transmission system operator, and whose output is dependent on a fuel resource that cannot be directly stored or stockpiled and whose availability is difficult to predict. Wind and solar power generation are the primary VERs, since the sun does not shine all the time (even during the day, clouds and dust can interfere with solar power generation in surprising ways) and the wind does not blow all the time. In some cases, hydro electricity without storage (so-called “run of river” hydro) could be considered a VER since its output is dependent on streamflows at any given moment. VERs are, in some sense, defined respective to so-called “dispatchable” or “controllable” power generation resources, which encompasses fossil-fuel plants, nuclear, and some hydro electricity (with reservoir storage). The VER concept is pretty vague if you think about it – after all, coal or natural gas plants can sometimes break, so don’t have perfect availability. Fuel supply chains can also be disrupted for fossil plants. In addition, the “variable” aspect is, at least in concept, nothing new for system operators. Demand varies all the time and system operators are able to handle it without substantial negative impacts.

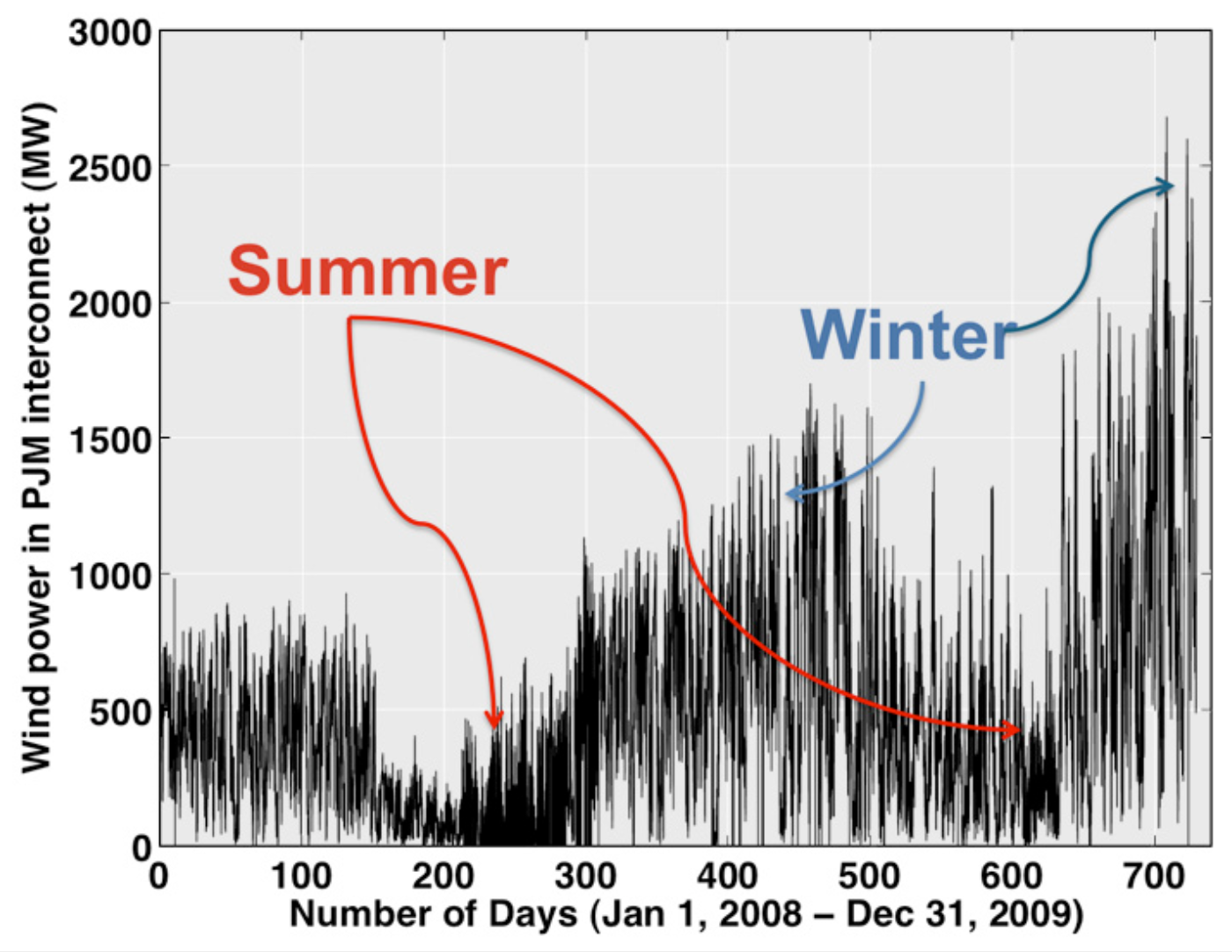

Keep in mind that the “variability” of VERs is different over different time scales. \(Figures \text { } 7-9\) of “Managing Variable Energy Resources to Increase Renewable Electricity’s Contribution to the Grid” show how wind and solar are variable over time scales of days or fewer. \(Figure \text { } 7.1\), below, shows wind energy production in the PJM RTO every five minutes over a period of two years. This figure shows how wind production varies seasonally and also inter-annually, with windier and less windy years.

\(Figure \text { } 7.1\): Wind energy production in PJM, 2008 and 2009.

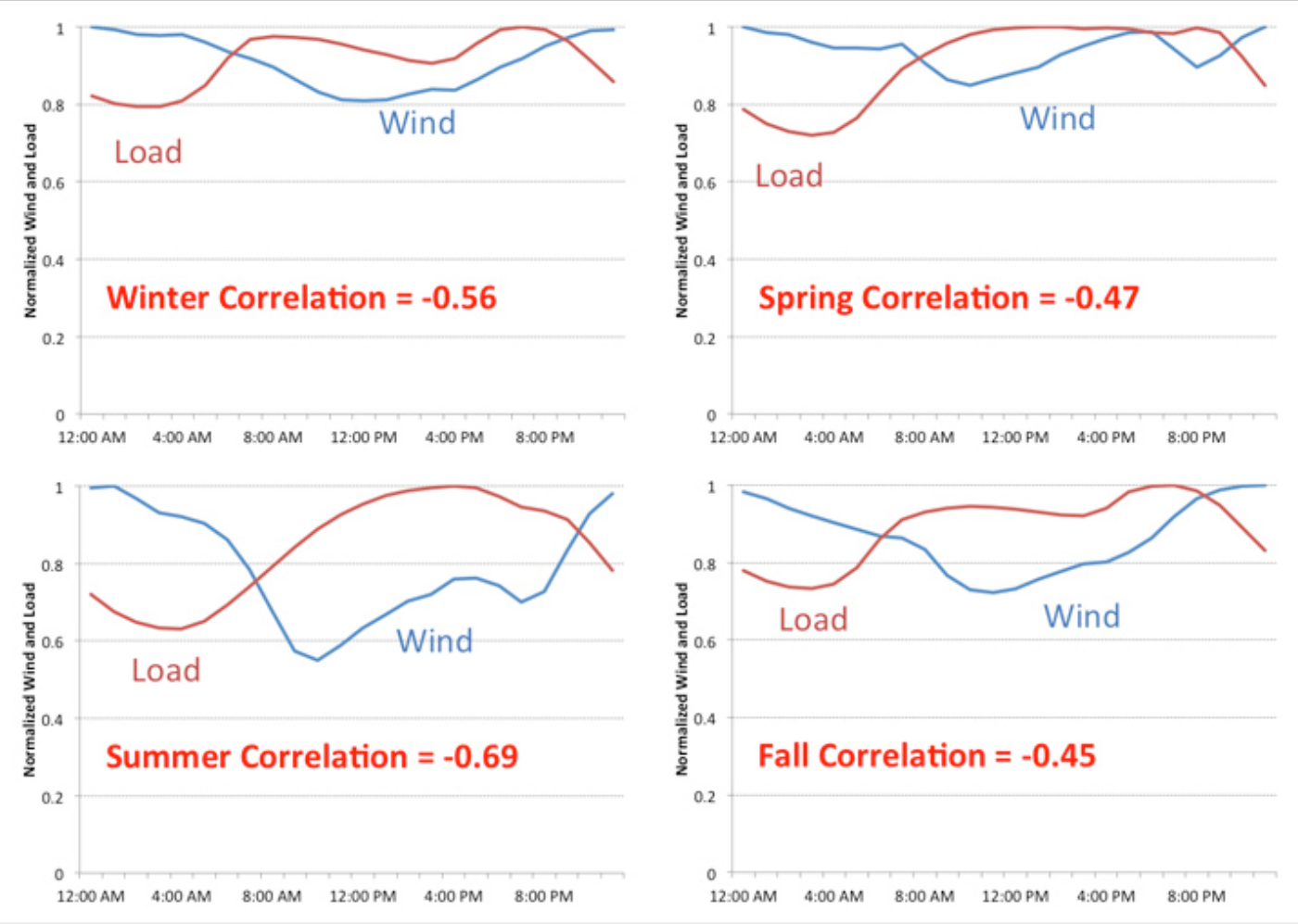

Variability with respect to electricity demand is also important. If you think about it, electric system operators don’t really care about variability in demand or in VERs per se – what they care about is being able to match supply and demand on a continuous basis. If variability between VERs and demand were perfectly synchronous, so that VERs would increase (or decrease) in output right at the moments when demand increased or decreased in output, then there would be no problems. If VERs and demand are anti-correlated or perfectly asynchronous, that poses more of a challenge. Part of the challenge with the wind in Vermont, as you have read, is that the wind tends to blow most strongly at night when there is less electricity demand and the power plants that are serving that demand are inflexible “base load” units that are difficult to ramp down. This is typical of wind – \(Figure \text { } 7.2\) shows (normalized) wind and electricity demand by season in the PJM RTO. Solar, on the other hand, is much more highly correlated with electricity demand (at least on a day-to-day basis).

\(Figure \text { } 7.2\): Normalized wind energy production and electiricity demand in PJM, 2009.

Whether or not you believe that there is anything “special” about VERs, electric grid operators around the world are rethinking the way that they plan and operate their systems and markets in order to accommodate various forms of policy that are promoting investment in VERs. Read the introductory portion of Chapter 4 of Energy Storage on the Grid and the Short-term Variability of Wind and pp.15-20 of “Managing Variable Energy Resources to Increase Renewable Electricity’s Contribution to the Grid,” which discuss various types of strategies that grid operators have been using to manage large-scale VERs on the grid. As you may have gathered from the Vermont article, some of the control strategies used most often by grid operators (such as manually curtailing wind energy output during periods when supply exceeds demand) have also been the most controversial.

More generally, there are three economic challenges relevant to VER integration, each of which we will discuss in a bit more detail.

- VERs tend to depress market prices for electric energy, sometimes even producing negative prices (which makes economists cringe but does make sense in the world of electricity). This is good for consumers, but not so good for power producers (both conventional generators and VERs). While this has certainly been a challenge for states in the U.S. that have seen rapid growth in wind and solar (primarily California and Texas), it is by no means a challenge specific to the United States. Germany, which has been very aggressive towards a renewable power generation transition, has seen a rise in frequency of negative prices, which is great for consumers (hey, you get paid to use cheap green electricity) but terrible for power generation companies. A solution to this challenge in some areas has been to establish “capacity” payments that are designed to make generators whole financially and keep power plants from retiring too early. You can see a nice animation of electricity prices, including when prices go negative, from the MISO market website. (You may need to refresh it to see the prices change. You can also look at a similar picture for the Texas grid, known as ERCOT.)

The emergence of low-cost solar photovoltaics and energy storage presents an additional challenge to the business models of electric utilities. This is more complex than the disruptive competition that new technologies can generate, because (as we learned in Lesson 5) the electric utility has a regulatory mandate to provide universal service at high reliability. If solar PV and energy storage steal business from the utility, then the social question arises of whether we find ways to continue to pay for the electric grid (for those who continue to depend on electric service from the grid) or whether we abandon the utility's social mandate to ensure electric reliability. You can read more about this in the report "The Economics of Grid Defection" from the Rocky Mountain Institute. - Fluctuations in VERs can sometimes happen too quickly for system operators to respond manually, so automated response systems are required. These are generically termed “ancillary services.” The economic challenge is that VERs increase the demand for ancillary services and probably require the establishment of new types of ancillary services.

- Part of the reason that the first two challenges exist is because demand for electricity is treated as being “inelastic” or unresponsive to price. Designing a financial mechanism that matches demand with VER production is a major potential application of “smart grid” systems. For now, electricity markets have opened programs for “demand response,” which offer payments to customers that are able to adjust demand quickly.